- Stocks and Income by Alts

- Posts

- Swaggy's Top Stonks - Special Issue

Swaggy's Top Stonks - Special Issue

Today, we’ve got a very special issue to share with our readers. It’s part of a three-part series I’ve put together to close out 2023 and kick off 2024 right.

Today: The worst investments of 2023

Next: The best investments of 2023

Finally: My best ideas for 2024

I hope you enjoy it.

1. China

It's been an awful year for China.

Covid

The government accidentally ended its zero COVID policy, and up to 1.5 million people died. The move was called “the most lethal event in peacetime China since the 1959-61 famine that followed the Great Leap Forward.”

Confidence

Consumer confidence is at an all-time low, sending spending to zero. Even luxury spending has tailed off.

Closed off

President Xi has become more paranoid in the first year of his third five-year term despite packing the committee with loyalists and proteges.

His Defence and Foreign ministers abruptly disappeared for a few months earlier in the year and were unceremoniously sacked upon their return.

Collapse

Real estate, which made up 30% of Chinese GDP not too long ago, is the most common wealth investment vessel for Chinese households.

It's imploding, which will have catastrophic and long-reaching effects.

Some 70% of retail savings is tied up in real estate, and many local governments depend on land sales to developers for revenue. Many of those developers are nearly bankrupt, and kickbacks to local bureaucrats are drying up.

Concern

Chinese citizens aren't happy, and both the 1% and 99% are fleeing in record numbers.

More Chinese citizens have been apprehended at the US-Mexico border in 2023 than the previous ten years combined.

More worrying, China saw the world's largest exodus of millionaires in 2023. More than 13,500 left, with the plurality fleeing to Australia.

Catastrophe

The problems are systemic and widespread.

"The country’s economy has struggled to recover from the impact of COVID-19 shutdowns and long-running structural problems have become impossible to ignore. The economic data has been troubling all year, and it’s not getting better. Foreign investment has plummeted, and capital outflows have grown sharply."

Youth unemployment has got so high the government has stopped releasing data. Speaking of data, official GDP growth came in at 5%, but that figure is widely disbelieved.

How bad is it? China funds made up 17 of the 20 worst-performing funds in 2023.

Conclusions

Some say China has peaked, which may be true.

But right on cue, government officials point to a rosy 2024.

Looking ahead to 2024:

I think it's going to get worse rather than better.

2. Fine Wines

Wine investors enjoyed a dizzying 2020 to 2022, with most Liv-Ex indices climbing 25 to 35% during the period.

But they're suffering through an epic hangover in 2023:

Every segment Liv-Ex tracks is down in 2023. Most are off around 15%.

Two-thirds have given back all their two-year gains

And Burgundy and port lovers are down on a five-year basis.

It's enough to drive me teetotal.

Staying away from this port in a storm

Despite much progress, the trading environment remains challenging moving into FY24, and as a result, we are undertaking further actions to ensure we fully right-size our stock levels and cost base.

This is almost never what you want to hear from an investment manager.

Meanwhile, inflation drove up the price of retail wine by around 8% to 10% despite slowing demand.

From Dame Janice Robinson, Oxford-educated British Master of Wine:

All these price rises come, contrarily, at a time when wine consumption is plummeting in key markets such as the US and UK. It is the first time in my long professional life that this has happened. There’s competition from abstinence and cannabis but also alternative alcoholic drinks, which are so much more interesting now than they were when a handful of mass-produced brands of beer and spirits ruled the world. And in these difficult economic times, it is becoming painfully clear to those who produce and sell it that wine is a discretionary purchase.

All of which:

Confirms the investment and consumption markets are distinct entities.

Has meant a price compression between everyday wine and the special stuff.

It gets worse when you compare wine to other markets.

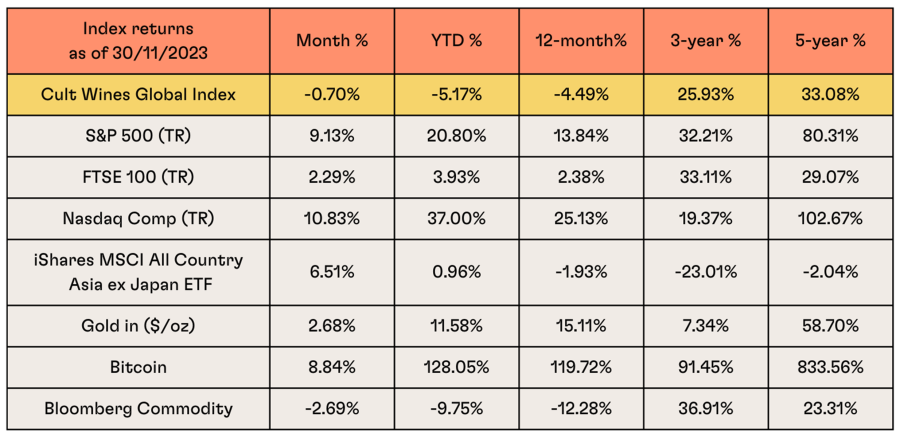

Via Cult Wines

First, well done to Cult Wines for smashing their benchmark. Losing 5.17% is better than losing ±15%.

But, among the investments in their table, only a broad basket of commodities (more on that later) performed worse than the boffins at Cult.

Looking ahead to 2024:

I spoke with Anthony Zhang, CEO at Vinovest, a couple of weeks ago, and they're (perhaps unsurprisingly) bullish on 2024.

He expects to see:

Stabilization of wine prices

Increased demand for grower Champagne

US economic recovery and a strengthening dollar favors Napa

Growing demand for Italy and Bordeaux wines; less interest in speculative Burgundies

He may be right about a comeback.

Up and to the right

Every time the market has drawn down since 2004, it's bounced back.

I don't know how much we can take from this, but it is potentially encouraging. The worry for me--if we're basing future returns on past results--is a doldrumic period similar to 2011 to 2016.

If the price of fine wines continues to collapse?

We'll all be drinking fantastic wines at affordable prices. Could be worse.

3. Manchester United & Chelsea FC

Sports team and league valuations have gone parabolic in 2023.

It's easy to see why.

Brands spent $20 billion sponsoring sports teams in 2023, led by a 30% jump in golf sponsorships and a 43% boost for rugby.

Meanwhile, the global value of sports media rights was $56 billion this year and is forecast to continue climbing for the foreseeable future.

The tide is rising across the board:

Saudi Arabia's made eye-watering investments everywhere that will take its money.

Women's sports investments are churning out ROIs their male counterparts could only dream of.

Formula 1 teams are up 232% over the last few years.

Literally everything has gone up and to the right.

Except for Manchester United and Chelsea FC, two of the world's best-known football (soccer) teams.

Manchester United is down 13% this year

The Glazer family bought Man U for $1.5 billion in 2005 and recently sold a 25% share for $1.6 billion. The company's shares are traded on the NYSE with a market cap of $3.3 billion today. Certainly not a catastrophic return, but the club's mismanagement, decade of awful on-field performance, and botched sale have resulted in a 13% loss in 2023 and only a 12% gain since 2018.

That's a significant loss once you factor in inflation, not to mention the opportunity cost of owning nearly any other sports franchise in the world.

But things could be worse. You could own Chelsea FC.

In March 2022, the British government forced Russian oligarch Roman Abramovich to fire sale the club as part of its sanctions against Moscow.

Clearlake Capital, fronted by Todd Boehly, bought Chelsea for $5.25 billion. A tidy return for Abramovich, who bought the club for $233 million in 2003.

Things have not gone well for Boehly.

Per the club's most recent Forbes valuation in May 2023, Chelsea is worth just over $3 billion. It's probably lower seven months later.

Why the 40% + drop?

Because Boehly is insane.

Over the last eighteen months, he's spent over $1 billion acquiring a mismatched bag of players on eight-year contracts (four to five years is typical).

Eight years lets him amortize the acquisition costs over a longer period to comply with the Premier League's financial fair play rules.

Clever Boehly.

But what happens when someone who doesn't know anything about the sport spanks $1 billion on players (plus $200 million a year in wages)?

It goes badly.

To be fair, this is an improvement over last year

Hilariously, Boehy's crew--who also own the Dodgers--have applied the same formula to baseball. Between Shohei Ohtani, Yoshinobu Yamamoto, and Tyler Glasnow, Boehy has committed the club to $1.2 billion in backloaded salary liabilities over the next twelve years.

Looking ahead to 2024:

While their onfield and management woes look to continue indefinitely, things are looking up in the boardroom for Manchester United. Sir Jim Ratcliffe has acquired a minority stake from the Glazers, and he's putting a stop to their bleeding the club dry financially.

Things are less rosy for Chelsea. They're nowhere near qualifying for the lucrative European competitions, and they'll be hobbled with the same mismatched crew of overpriced players through 2030. It's a death spiral for the club, and as a Liverpool supporter, I'm 100% here for it.

4. Commercial Real estate

It's been an awful, no good, very bad year for real estate investors.

2023 has given us a million stories just like this one.

Office is taking it on the chin.

“Aon Center, the third-tallest tower in Los Angeles, has sold for $147.8 million — about 45% less than its last purchase price in 2014 — as office values continue to suffer from high vacancies and financing costs”

— Lance Lambert (@NewsLambert)

8:51 PM • Dec 23, 2023

While the sale above isn't uncommon, it is extraordinary. This property, whose value had surely climbed since its last sale in 2014, just sold at a 45% discount to the original purchase price. Factoring in inflation and the likely valuation increase through 2019, it's possible the owner took an 80% - 90% haircut from peak to sale.

Funds and REITs have had an awful year as well.

Wheeler REIT is one of a great many commercial REITs that have collapsed this year as rates have climbed and valuations plummeted.

It looks worse if you scale back to 2021

The collapse's impact spreads beyond financial losses. One high-profile (for Twitter) solo real estate lost everything this year and killed himself.

Looking ahead to 2024:

I think it's going to get worse and it's going to spread further into residential real estate.

Rates will come down in the US in 2024, but not as quickly as everyone hopes. Unemployment, particularly among the young, will increase, and we'll begin to see foreclosures become more widespread across both residential and commercial properties.

This sudden influx of supply will dislodge the supply/demand gridlock, keeping valuations artificially high today and will result in some ugly price discovery.

5. Gold

We'll wrap it up with a perennial loser - gold.

But wait, gold is up nearly 13% this year!

How is it possibly one of 2023's worst investments.

Because every dollar you invested in gold wasn't invested in Bitcoin.

Sure, investing in gold is great, but have you tried investing in Bitcoin?

Just for fun, here's a ten-year chart comparing the two.

Is < 20% over a decade good?

Gold is stupid.

6. (Dis)Honorable Mentions

And as a special treat, a few dishonorable mentions:

That’s all for today. Did we miss anything? Smash the reply button to let us know.

Cheers,

Wyatt

The